Quality of Financial Models (FY24 Update)

Just like every year, we did analysis on our financial models performance and here is the detailed sector-wise analysis of our coverage of 1026 companies.

Use our tailor-made solutions for cutting edge Stock Research, Financial Analytics, Portfolio Analysis & Monitoring, Automated Client Reporting & Engagement across asset and wealth management.

Bespoke solutions for Research, analytics, operational automations, reporting and Client Engagement.

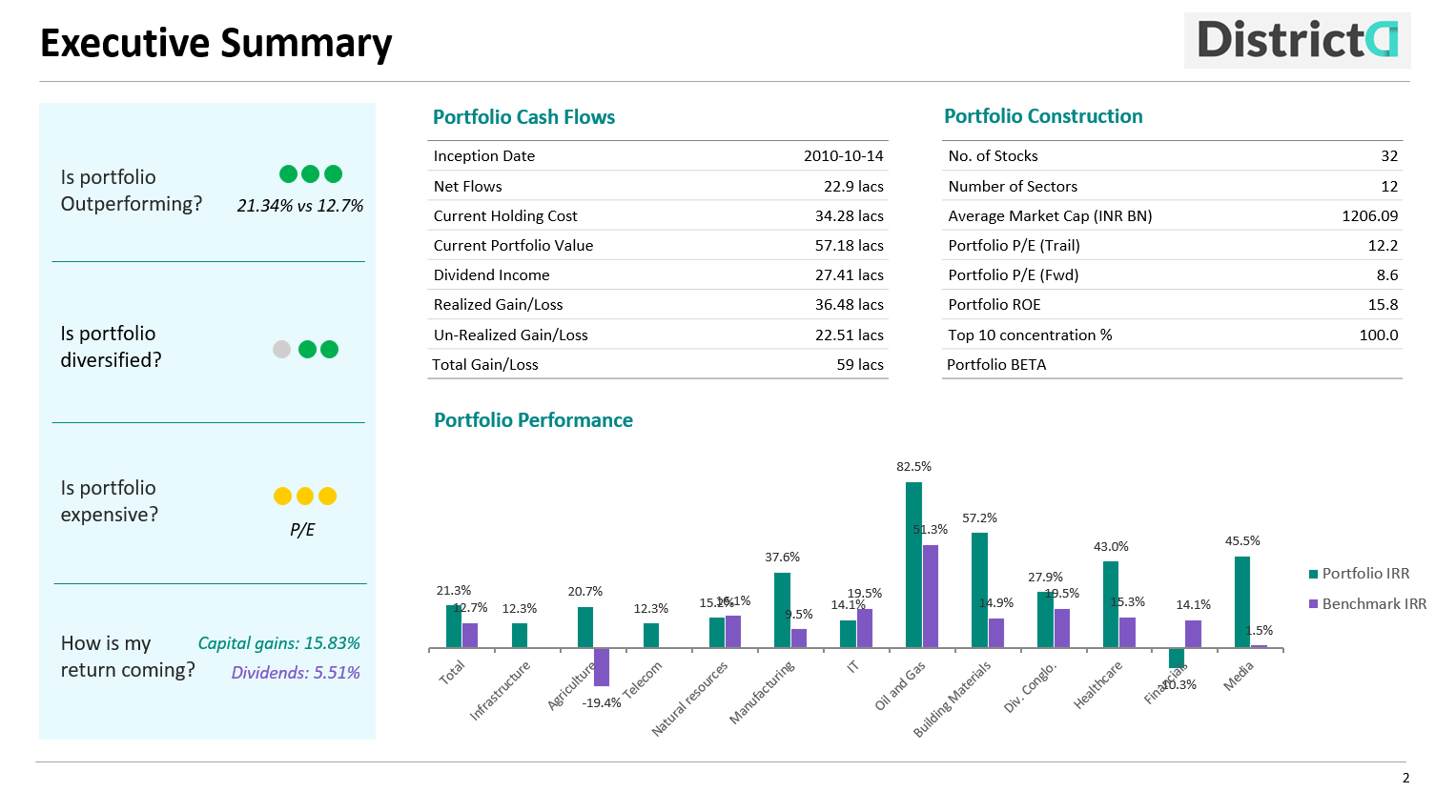

Elegant & deep analysis of portfolios to generate new investment ideas. No more standard colorless reports, but completely tailormade Portfolio Reviews & Investment Proposals.

High quality proposals for new prospects.

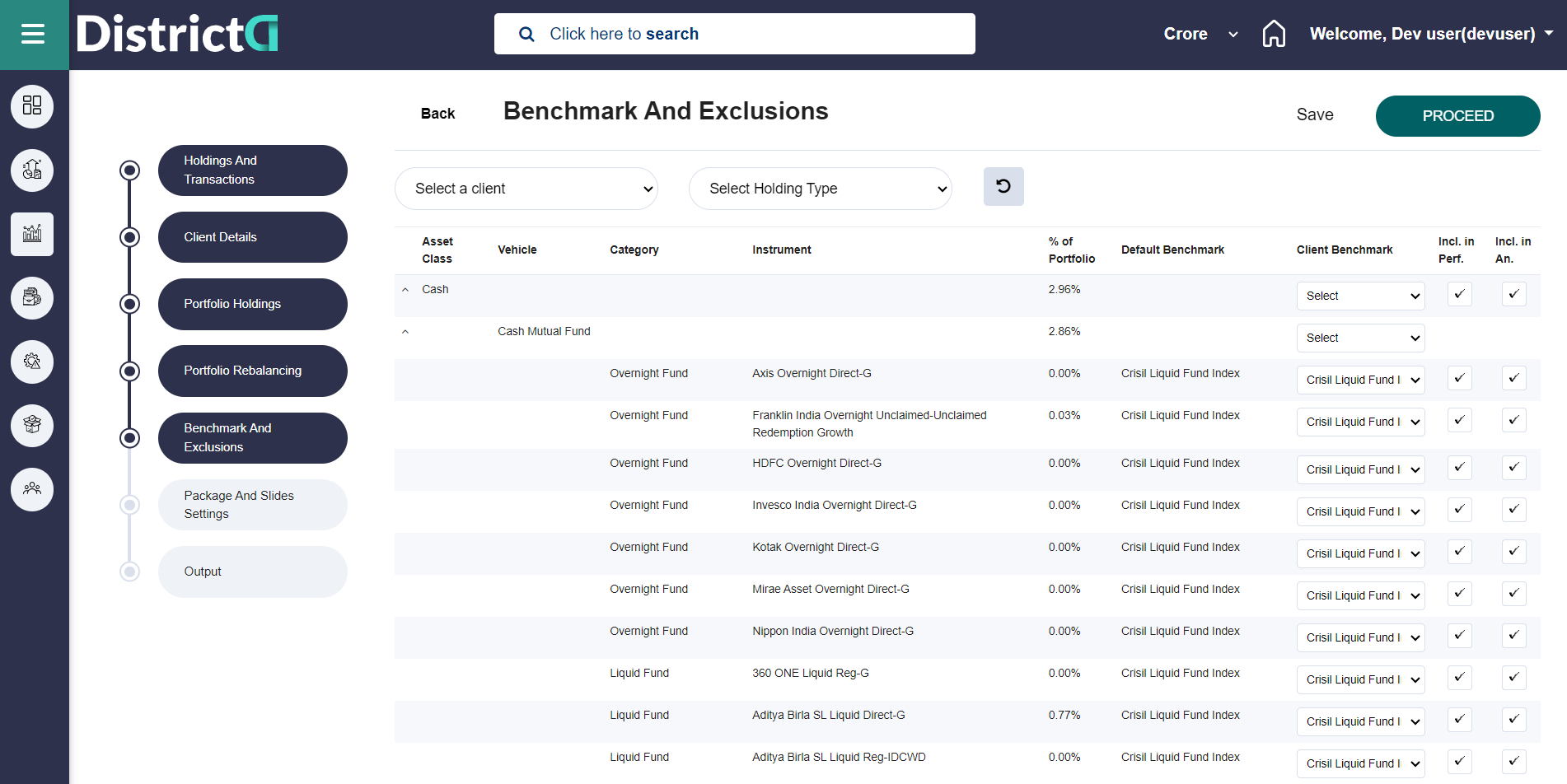

Deep analytics, portfolio performance and benchmarking.

Leverage technology to build scalable and efficient systems to help cater to a wider client base with wider use cases.

Manage 2x-3x more clients with the same workforce.

Drastic reduction in cost & time for portfolio reviews and proposals.

Move beyond the data keeping tasks of a back office. Empower all teams to achieve client facing actionables efficiently.

Drive coordination using single platform between RM, Advisory, Product and Service team.

Data flows seamlessly across teams and use cases.

Globally actualize cost effective with resource maximizing leadership skills.

Indepth portfolio reviews for both clients and prospects. Ability to merge and analyse portfolios from multiple sources as well.

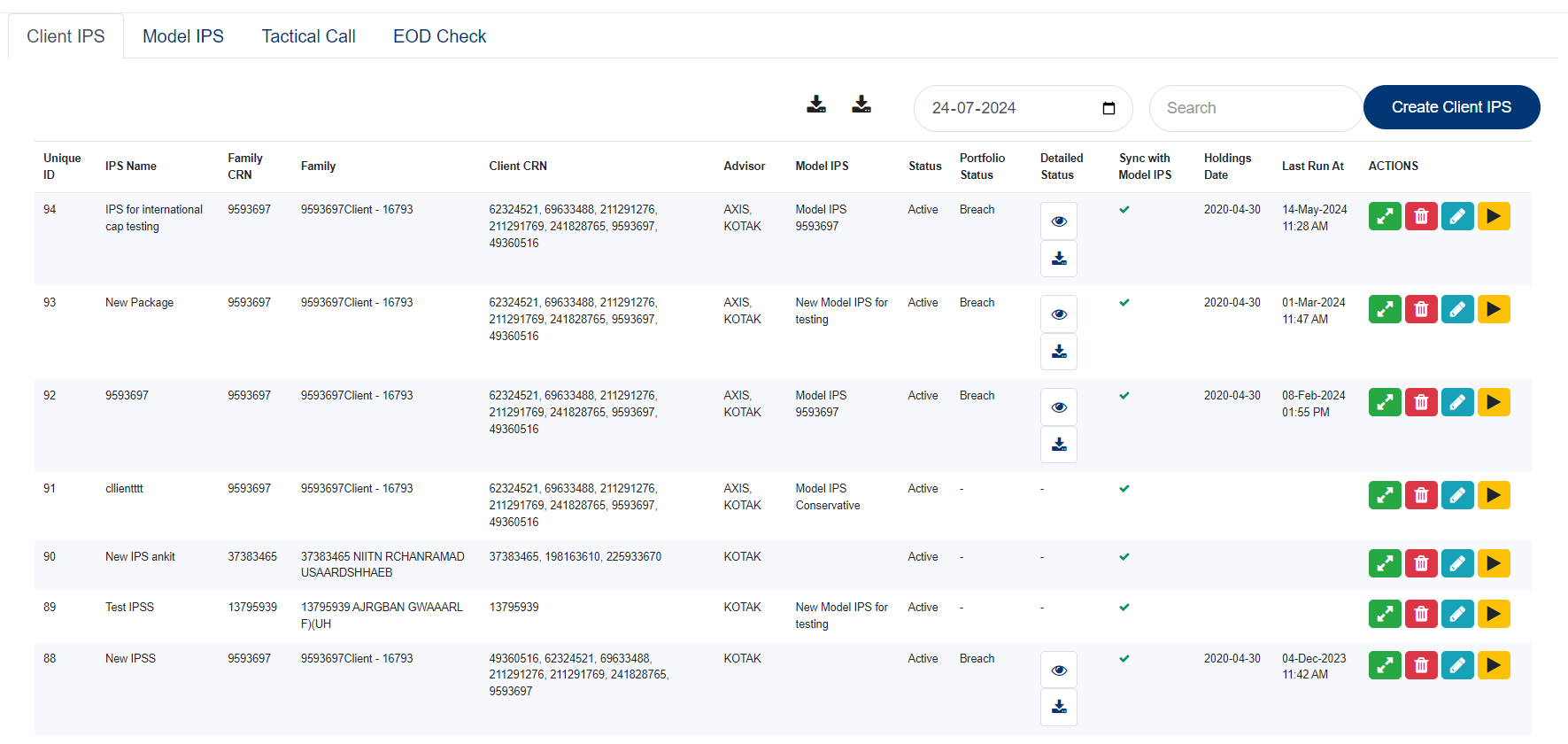

Monitor portfolios scientifically. Create and monitor Investment Portfolio Guidelines (IPG) across 80+ parameters. Automated alerts for deviations.

Maintain Model Portfolio strategies mapped to risk/client profiles and generate proposal decks.

Integrate multiple teams on the same platform to derive synergies in working. Data moves seamlessly across multiple teams triggering actionables.

We work across multiple internal stakeholders; design an effiicient solution to drive long-term value.

Deep domain experience across Investment & wealth management and banking.

Expertise in latest Tech Stack and AI/ML domain.

5 out of top 20 wealth managers partner with us.

We bring new ideas to keep you ahead of the curve.

Just like every year, we did analysis on our financial models performance and here is the detailed sector-wise analysis of our coverage of 1026 companies.

As Q3 FY24 begins, DistrictD launches machine generated raw concall transcripts.

Most of what I previously wrote was from our point of view, our vision, our ideas etc. However this is one from the other end. Over the past year I have interacted with nearly 500 professional investors, fund managers, brokers, analysts, bankers, consultants across all sizes of institutions. I saw them as my advisors, mentors, clients, friends and took in whatever they had to throw at us. Went back to our desks, updated our plans and solved the problems that they gave us.